With the COVID-19 pandemic, political divisiveness, civil unrest, and an economic recession, 2020 was one of the most tumultuous years in modern U.S. history. As uncertainty and fear radiated across the nation and around the world, many Americans upended their lives almost overnight. The fortunate retreated to their homes, which have become havens of not only shelter but also work and recreation. As people hunkered down and safety precautions took hold, business and leisure travel all but ceased, and traditional gathering and entertainment venues, such as theaters, concert halls, and even restaurants, went dark. The architecture, engineering, and construction market reflected this roller-coaster year with significant declines in some sectors and notable increases in others. With 2021 bringing continued uncertainty to the market, analysts predict that recovery is on the horizon in 2022.

FMI Corp.’s 2021 Engineering and Construction Industry Overview: First Quarter Outlook projects that, once tallied, final figures will show that total engineering and construction spending was down just 1% in 2020 compared with 2019. Yet that number is misleading. Spending in some nonresidential sectors plummeted as much as 17% in 2020 compared with 2019, FMI reports, while residential construction bolstered overall spending with gains of 8% for single-family units and 10% for home improvements. Public safety and water supply infrastructure also buoyed the market with spending increases of 13% and 11%, respectively. “While some geographies and industry sectors remained unscathed, or even thrived, most of the industry struggled with the pandemic’s impacts on people, projects, and profits,” says FMI CEO Chris Daum in the company’s report. “These challenges continue to define the E&C industry’s operating environment as we move into 2021.”

As COVID-19 vaccines proliferate nationwide and a new administration presides in Washington, economists are projecting a slow and uneven recovery with continued turbulence in 2021 before what is expected to be a more positive outlook in 2022. “A lot of the same issues that we faced in 2020 are still present at least through the first half of 2021,” says Richard Branch, chief economist for Dodge Data & Analytics.

“We don’t expect the overall economy to start posting stronger growth until the second half of the year. That growth will be in lockstep with the further rollout of the vaccines. As more Americans are vaccinated, that will allow some of these activities — like eating out, traveling, and seeing our friends — to resume, which will eventually feed demand for further construction. But it’s going to be a long road back,” notes Branch.

As COVID-19 vaccines proliferate nationwide and a new administration presides in Washington, economists are projecting a slow and uneven recovery with continued turbulence in 2021 before what is expected to be a more positive outlook in 2022.

One indicator of the marathon ahead is the 2021 Dodge Construction Outlook. It suggests that construction starts, which plunged 14% to $738 billion in 2020, will gain a little more than 4% to $771 billion in 2021, remaining well below pre-pandemic levels.

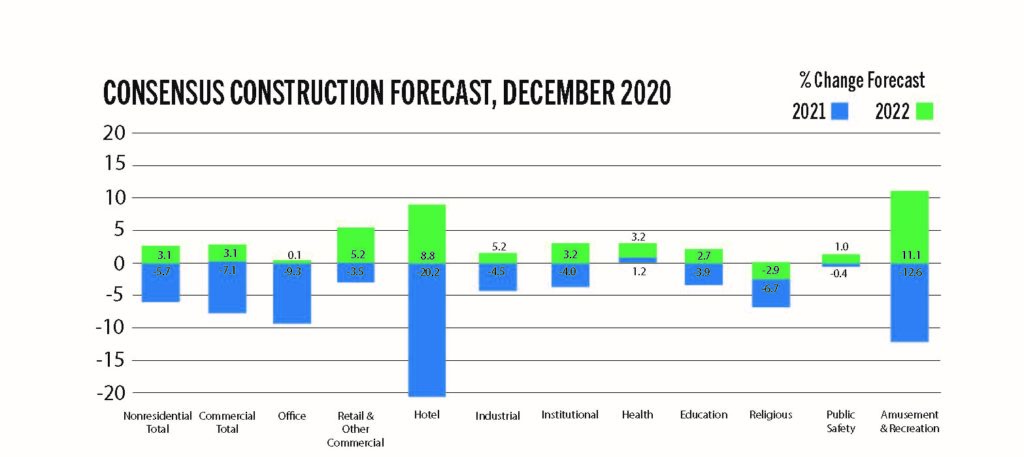

Another indicator, the American Institute of Architects Consensus Construction Forecast, which compiles data from the nation’s leading AEC market forecasters, anticipates a 6% decline in overall engineering and construction spending in 2021 before growth returns in 2022. “The financial scars across most building markets are pretty deep, and it’s going to take time for those scars to heal to the point where construction can resume stronger growth,” Branch warns.

“Looking at the big picture, 2021 is going to be a bridge year. Once we’re beyond 2021, there will be much stronger growth in the economy and in construction,” he continued.

On the upside

While some AEC sectors must wait for the pandemic’s end to rebound, other areas have flourished not in spite of but because of the pandemic. Last year, as the U.S. economy spiraled into recession, analysts contemplated what the AEC market’s eventual recovery would look like. Would it be V-shaped, with a sharp decline and rapid ascent? Or maybe L-shaped, with a sharp drop and slow return to pre-pandemic levels?

As it turns out, the market is experiencing a K-shaped recovery, as residential demand soars while nonresidential interest wanes, says Brian Strawberry, a senior economist with FMI. “This can largely be attributed to the government’s response to the pandemic,” he says, noting that low interest rates, multiple economic stimulus packages, eviction moratoriums, and mortgage forbearance policies have bolstered the residential market while safety measures that forced some business closures reduced nonresidential appeal.

Widespread pandemic-induced behavioral changes, some of which are expected to endure for years to come, are also fueling bifurcation in the market. For instance, as social distancing became the norm for slowing the transmission of COVID-19, people across the country turned to online retailers for everything from flour for baking bread to puzzles for entertainment. This surge in online shopping, which, according to the U.S. Department of Commerce pushed total e-commerce sales up 32.4% to about $792 billion in 2020, is driving the need for additional warehouse and distribution space nationwide.

The market is experiencing a K-shaped recovery, as residential demand soars while nonresidential interest wanes, says Brian Strawberry, a senior economist with FMI.

FMI reports that warehouse construction grew from approximately one-quarter of put-in-place commercial construction in 2015 to nearly half in 2020, representing approximately 18% growth year over year. “As an increasing number of us do more of our shopping through Amazon and other online retailers, one of the sectors on the upside of that K-shaped recovery is warehousing,” Branch explains. “These companies need more warehouse and fulfillment facilities to meet the next- and same-day delivery expectations that have become the industry standard.”

Pandemic-induced behavioral changes are also spurring another sector on the upside of the K: residential construction. As companies nationwide shuttered their offices and adopted teleworking arrangements that comply with social distancing recommendations, employees realized that they no longer needed to live in proximity to office buildings. This, coupled with low interest rates, has sparked an exodus from high-cost, densely populated urban centers, like San Francisco, New York, and Washington. “People, mostly millennials — who have been living in multifamily structures in densely populated cities — are searching for space and affordability out in the suburbs and rural areas,” Branch says.

“Part of that is natural aging and maturation of the millennial age group. They’re now in their early to mid-30s, and they’re starting to have families, which is generally when people start to look for more space and better schools in the suburbs. But the pandemic and the change in how people work has accelerated this exodus,” explains Branch.

The PSMJ Resources Inc. Quarterly Market Forecast analyzes engineering and construction proposal activity using its Net Plus/Minus Index to express the difference between the percentage of firms reporting increases and those reporting decreases in proposal activity. The forecast shows that in the fourth quarter of 2020, housing matched or exceeded pre-COVID-19 levels.

According to the forecast, housing ended 2020 with an index of 43%, up from 38% the prior quarter, marking the highest-ever recorded NPMI for the housing sector since the firm began tracking it in 2006. Of the 58 submarkets that PSMJ follows, single-family individual housing (59%), multifamily housing (58%), and single-family developments (51%) were among the top performing in the fourth quarter of 2020.

Remote working, tight real estate inventories, low-interest refinance activity, and other related factors have also driven home improvement spending, which has included new home offices, kitchens, bathrooms, landscaping, pools, and other upgrades, according to FMI’s first-quarter outlook.

“These improvements have in many cases been put off from prior years but are also a means to upgrade living spaces and accommodate more time spent at home,” the FMI report states. “Improvement spending through the outlook period will remain well aligned with single-family construction. Anticipate continued strong growth through the first half of 2021. However, prepare for a future correction when supply and prices begin to balance, investment sentiment becomes challenged, government programs expire, and/or there is some return to normal working conditions.”

As for public safety, the FMI report says that the social unrest that occurred throughout the nation as people protested everything from police violence to stay-at-home orders spurred the 13% growth in that sector.

Two other sectors that have thrived during the past year are water supply and public safety construction. FMI’s report shows that a $1.4 trillion omnibus package under the 2020 Water Resources Development Act drove water supply spending up 11% in 2020 over 2019. That spending is expected to level off in 2021.

As for public safety, the FMI report says that the social unrest that occurred throughout the nation as people protested everything from police violence to stay-at-home orders spurred the 13% growth in that sector. “The spike in public safety spending was a bit of a surprise to us,” Strawberry admits. “We’re talking about prisons, police stations, and fire stations. It’s unclear exactly where that investment was spent. I wouldn’t expect that growth to continue.”

On the downside

On the downslope of the K-shaped recovery are most of the other markets across private and public construction, Branch says. The same behavioral changes that have boosted residential construction are also responsible for much of the decline in these markets. As people have stayed home and away from gatherings, nonresidential construction has contracted.

AIA’s forecast shows that in 2020, construction of commercial facilities declined 7%, industrial building construction retracted 4.5%, and institutional construction decreased 4%. FMI breaks it down like this: lodging sunk 17% to $28 billion, office buildings fell 6% to $80 billion, religious spaces decreased 16% to $3 billion, educational institutions slid 4% to $101 billion, amusement and recreation centers receded 9% to $26 billion, transportation infrastructure dipped 1% to $57 billion, and manufacturing facilities dropped 8% to $73 billion.

FMI reports that health care center and communication infrastructure spending remained stable over the period.

Of the 12 major markets that PSMJ studies, energy/utilities led with an NPMI of 47%, up from 28% in the third quarter of 2020 and even higher than its pre-pandemic rating of 43% in the fourth quarter of 2019.

“The pandemic induced a steep recession, and we’re seeing that play out differently in different sectors,” says Kermit F. Baker, AIA’s chief economist. “The hardest-hit sectors were the commercial facilities — retail and lodging, in particular. With institutional, it’s more of a mixed bag (because) health care actually grew a little bit, while education was down somewhat. And then there are the amusement and recreational facilities, things like sports facilities and stadiums, and they obviously saw steep declines because of the precautions in place to limit big concentrations of people. I think that’s going to be the trend that we see moving forward. Based on government figures, we’re expecting almost a 6% decline overall in 2021 — a little steeper on the commercial side and a little less steep on the industrial and institutional side — before recovering in 2022.”

Construction corrections

The Associated Builders and Contractors’ Backlog Indicator reflects the past year’s market declines. It shows that in January 2021, contractors had 7.5 months of project backlog on their books, down from 8.4 months in January 2020 but up slightly from 7.3 in December 2020.

“We’ve generally seen a curtailing in backlog, which means that contractors are working through their under-contract projects faster than they’re generating new opportunities,” says ABC’s chief economist Anirban Basu. “There are a lot of competing forces shaping this data. On the one hand, there is the weaker commercial real estate environment; that’s hotels, office buildings, (and) shopping centers. And on the other hand, the pandemic has created this tug-and-pull with projects being postponed and then coming back online.

“Indeed, I think one of the reasons that we’ve seen the backlog edge a bit higher recently is not because of underlying economic factors, but in fact because some of the projects that were delayed in 2020 are now coming back to life.”

PSMJ’s forecast shows that much of the market’s movement throughout the past year has in fact coincided with the pandemic. The firm reports that when COVID-19 cases began spiking during the second quarter of 2020, the NPMI tanked to a “near-record-worst” of -22% before rebounding to 10% as COVID-19 cases leveled in the third quarter. The index then slipped again to 5% as cases resurged in the fourth quarter.

Of the 12 major markets that PSMJ studies, energy/utilities led with an NPMI of 47%, up from 28% in the third quarter of 2020 and even higher than its pre-pandemic rating of 43% in the fourth quarter of 2019. “Its surge is attributable to a huge bounce in the renewable energy submarket, which reported an NPMI of 75% in the fourth quarter,” the report says. “Utility distribution (59%) and telecom/cables (39%) were also strong.”

Under President Joe Biden, renewable energy and infrastructure spending could continue to expand. Biden has indicated that behind the $1.9 trillion COVID-19 relief package that he signed into law in March, one of his top priorities is an infrastructure revitalization plan, with special consideration given to renewable energy. During his presidential campaign, Biden proposed a $2 trillion plan for clean energy, public transit, and road and bridge repairs aimed at tackling the nation’s crumbling infrastructure while creating unionized jobs.

Under President Joe Biden, renewable energy and infrastructure spending could continue to expand.

Such investment is long overdue. ASCE’s 2021 Report Card for America’s Infrastructure gave the nation’s infrastructure a C-, noting that across the country a water main break occurs every two minutes, 43% of public roadways are in poor or mediocre condition, and 10,000 miles of levees remain unaccounted for and unchecked. (Read “ASCE’s 2021 Report Card marks the nation’s infrastructure progress,” Civil Engineering, March/April 2021.)

“The Biden administration has spoken a lot about infrastructure already and seems committed to accelerating expenditures on infrastructure,” Basu explains. “Part of the motivation for that, of course, is to accelerate recovery from the COVID-19 economic downturn. But it will be interesting to see if the Biden administration can pass a meaningful infrastructure package. And by meaningful, I don’t mean just dollars leaving federal coffers to finance projects that are local or national in scope, but rather for the federal government to actually find new funding sources for infrastructure. Federal infrastructure spending relies heavily upon fuel taxes, the rates of which have not been raised since 1993. And now we have the specter of electric vehicles that will further hammer away at those fuel tax receipts. You put it all together, and this nation has some real problems.”

An infrastructure package from the Biden administration could include more than just energy and transportation projects. It could also include building construction. “The Biden administration seems to be in concert with this expanded definition of infrastructure that has been building momentum over the past decade, which includes some institutional facilities as well,” Branch explains. “It’s this concept of social infrastructure, like community centers and other buildings that could support a more vibrant community. That could potentially generate some work for the AEC industry.”

Location, location, location

As industry members consider opportunities this year and beyond, the pandemic’s impact will remain an important factor. For instance, the pandemic-induced shift to teleworking has allowed some people to live where they want regardless of their employers. Many people are settling in the nation’s midsection, which analysts predict will outpace other areas of the country in construction spending this year.

The FMI report states that the top four performing census divisions will be: Mountain, East South Central, and the two divisions that make up the Midwest Census Region — West North Central and East North Central. “The tagline that I use is, ‘The South and West are the best,’” says Branch, who notes that the Midwest and Texas are certain to draw people searching for affordable single-family living.

With remote working expected to endure long after the pandemic ends, analysts predict that new office construction will continue to decline through the next couple of years, and the nation will see a surplus of existing office space, driving steep declines in rents.

With remote working expected to endure long after the pandemic ends, analysts predict that new office construction will continue to decline through the next couple of years, and the nation will see a surplus of existing office space, driving steep declines in rents. “One of the things that we’ve learned through the pandemic is that many people can be as productive or more productive working from home than in the office, and that will truncate the demand for office space,” Basu asserts. “In order to retain tenants and to secure new ones, many landlords will strategically reduce rents. The rents that will fall furthest and fastest are among Class A and Class A+ office buildings because they have the most room to drop their rates.”

While demand for office space will fall, AEC firms could find opportunities in retrofitting remaining office space to meet new expectations brought on by the pandemic, Baker says. “More and more companies over the last several decades have gone from completely enclosed offices to cubicles to open space; I think that trend of fewer square feet per employee is going to reverse pretty dramatically for health reasons,” he says. “We’re going to go back to the Mad Men-era private offices, or at least something with less density and more social distancing. You’ll also see upgrading of (heating, ventilating, and air conditioning) systems and other things for enhanced airflow and air filtration since we’ve learned that these viruses spread more easily in enclosed spaces.”

In addition to excess office space, many major metropolitan markets will have an oversupply of restaurant and retail space due to closures prompted and/or accelerated by the pandemic, the FMI report states. “One of the things we suffered last year was a vast array of major retail bankruptcies. Pier 1 Imports, True Religion, Neiman Marcus, J. Crew, J.C. Penney, GNC, Lord & Taylor, Francesca’s — each of them went bankrupt,” Basu says. “And then there are some companies that did not go bankrupt but who are closing stores by the dozens nonetheless, including the likes of Macy’s. So, we will come out of this pandemic with an abundance of vacant retail space, and that will diminish the demand for new retail construction.”

All that empty office and retail space could generate opportunities for AEC firms, however, as demand for adaptive reuse rises. “That space needs to be reused in some way,” Basu says. “It might be for outpatient medical centers, or it might be for affordable housing, or it might be for fulfillment and data centers. Whatever the case, that requires design work, or at least redesign work, as these structures are adaptively reused. I expect to see a lot of modifications of existing structures. There will also be a fair amount of tear-down activity and then rebuilding on various sites in order to meet unmet demand for data centers, fulfillment centers, and other needs.”

In light of these changes, economists say that AEC firms must remain nimble in the pandemic’s wake. “This is not going to be a copy-and-paste recovery compared to the aftermath of the Great Recession in 2008-2009,” Branch warns. “The pandemic and the fallout from an economic perspective mean that opportunities for growth in 2021 in the construction sector are going to be harder to find. They are there, but firms that play in that sector are going to need to be creative in searching out those opportunities, and more importantly, they’re going to need to be aggressive when they find them — because other firms are going to be doing the same thing.”

With the nation poised to emerge from the pandemic in late 2021, the overall economy is expected to begin rebounding, which will in turn drive growth in the AEC market.

Strawberry agrees. “Great opportunities are still going to be out there,” he says. “AEC firms should be flexible and willing to change course to take advantage.”

To succeed, Baker suggests that firms expand their scopes to consider different projects than they might have pursued in the past. “Generally, when we go through cycles like this, new construction projects tend to be smaller and more targeted,” he says.

“It’s going to be several years before we see a resurgence in the megaprojects that we saw in the 2017, ’18, ’19 period. And a lot of folks in the industry are going to have to really start looking for new clients and recognizing that some areas that have been traditional strengths for them are not going to be strong moving forward. They need to expand their search a little bit in terms of finding areas that are going to see growth moving forward, and that may be a different list than the ones that have provided their business over the last few years,” Basu states.

With the nation poised to emerge from the pandemic in late 2021, the overall economy is expected to begin rebounding, which will in turn drive growth in the AEC market.

Still, economists agree that it will likely take years for the market to return to pre-pandemic levels. “The forecasts suggest that construction activity is going to pick up in 2022 with 3% growth for that year,” Baker says. “Assuming that’s accurate and that the 6% decline that’s projected for this year is also accurate on top of the 2% decline last year, that would suggest that we won’t reach pre-pandemic levels until we get into 2023, probably midyear or so. We still have a lot of uncertainty ahead.”

This article first appeared in the May/June 2021 issue of Civil Engineering as “A Bridge Year.”